Unlike fiat currencies, which can be stored in a bank or pocket, cryptocurrencies require specialized wallets to manage digital assets. These wallets store private keys, enabling users to access and transact their crypto on blockchain networks. Wallets vary from custodial (managed by exchanges) to non-custodial (user-controlled) options, including software and hardware wallets.

This article explores non-custodial software wallets, focusing on seven alternatives to MetaMask. These wallets connect to blockchain networks, offering user-friendly interfaces for managing assets and interacting with dApps. Each wallet supports different blockchains and features, catering to diverse user needs.

MetaMask, launched in 2016 by Consensys, is a widely used wallet for Ethereum and Ethereum Virtual Machine (EVM) compatible networks, such as Polygon and BNB Smart Chain. Available as a browser extension and mobile app, MetaMask supports over 30 million users, according to download statistics. It enables users to interact with dApps, manage tokens, and add custom EVM networks.

While MetaMask is popular, some users seek alternatives due to its focus on EVM chains or concerns about data privacy, prompting exploration of wallets with broader blockchain support or enhanced features.

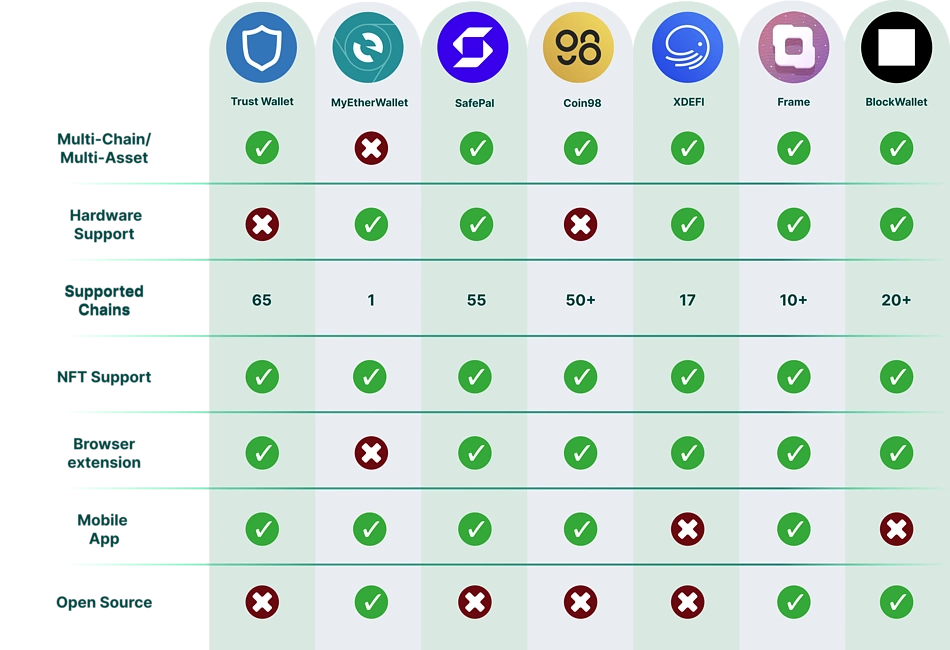

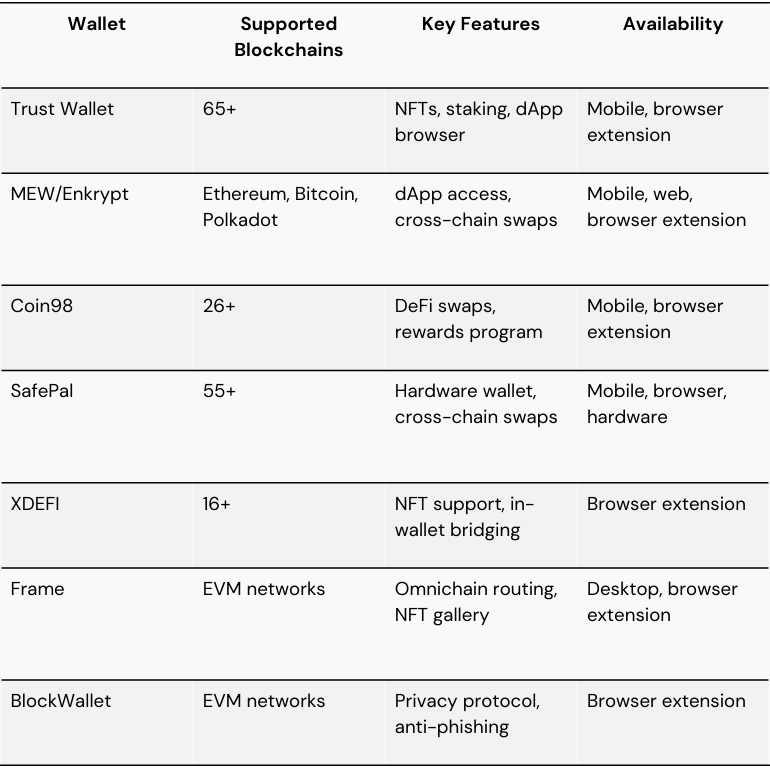

MetaMask remains a top choice for Ethereum and EVM users due to its intuitive design and dApp integration. However, alternatives like Trust Wallet, SafePal, and others cater to users needing multi-chain support, enhanced security, or NFT management. When selecting a wallet, consider factors like supported blockchains, security features, and compatibility with your preferred networks.

Always prioritize security by safeguarding your seed phrase and researching wallet providers’ privacy practices. This article is for educational purposes only and does not constitute financial advice. Conduct thorough research before choosing a cryptocurrency wallet or investing in digital assets.

Disclaimer: The information provided is for educational purposes only. It is not financial advice. Cryptocurrency investments carry risks, and users should perform their own due diligence before using any wallet or engaging with digital assets.